PROTECT COUNTY REVENUES

During his February 17, 2021, Budget Address, Governor JB Pritzker proposed a 10% reduction to the amount of income tax dollars the state would share with county and municipal governments within the State Fiscal Year (SFY) 2022 State Budget. This equates to a $152 million reduction to counties and municipalities throughout the state compared to distributions in SFY 2021. The purpose of the reduction is to divert local funds to partially offset the State’s $3 billion budget deficit.

This diversion of local revenues will harm counties by imposing additional pressures on local budgets at a time when resources are already being stretched to fund expenses created by the COVID-19 emergency response.

What is the Local Government Distributive Fund?

State-shared income tax revenue is distributed to local governments through the Local Government Distributive Fund (LGDF). LGDF is a state and local funding partnership instituted as part of the establishment of the State income tax in 1969. LGDF revenue helps local governments fund essential services and programs such as public safety, public health and basic infrastructure construction and repair. This shared revenue also reduces the amount of revenue local governments must collect through local taxes.

ISACo's Policy Brief on LGDF is available via this link.

Recent History of LGDF Distributions to Local Governments

Since its establishment as part of the enactment of the state income tax in 1969, the Local Government Distributive Fund (LGDF) represents a successful and critical state and local partnership for funding essential programs and services relied upon by county residents.

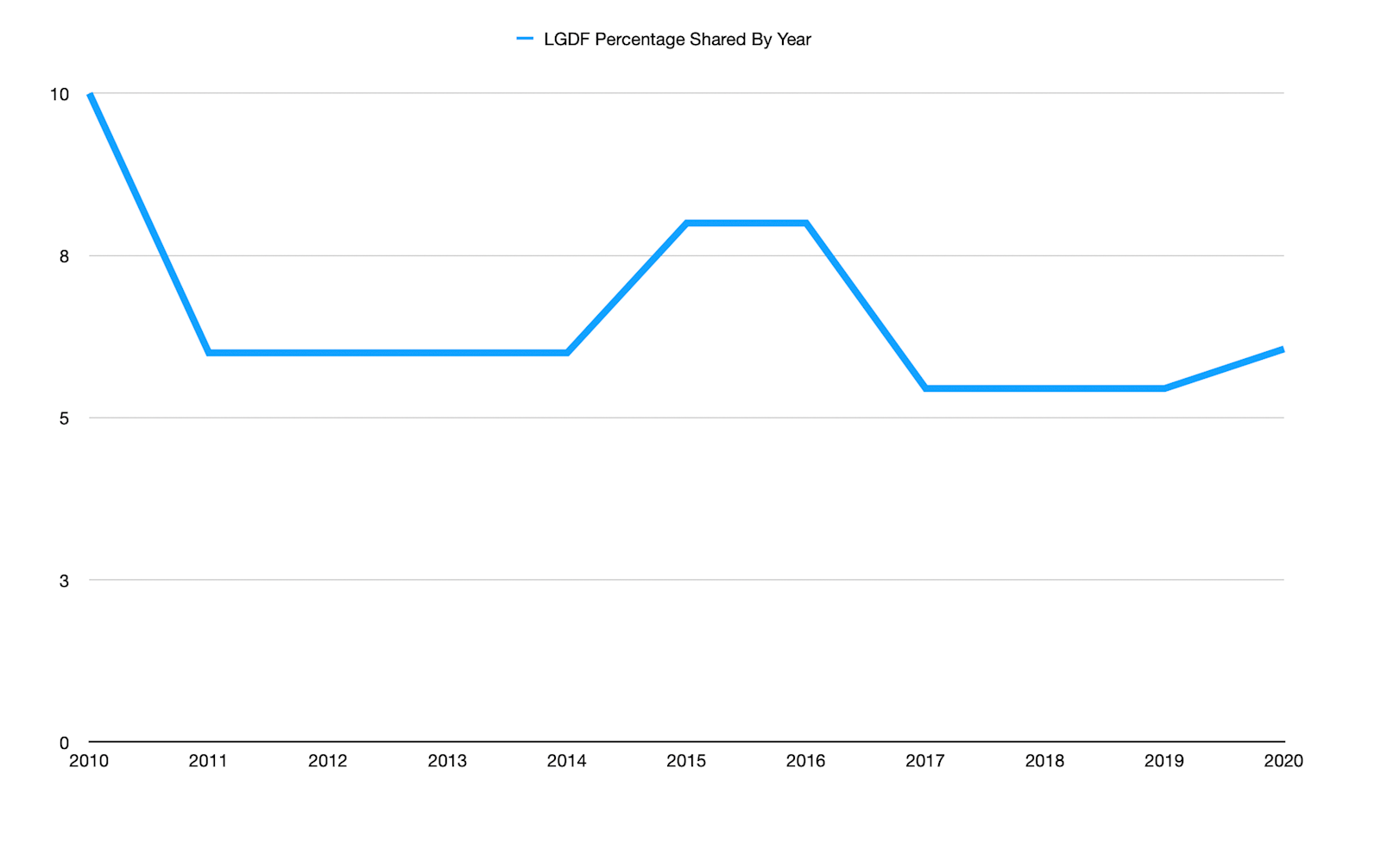

LGDF as Percentage of Total Income Tax Collections

LGDF as Percentage of Total Income Tax Collections

Prior to January 2011, counties and municipalities received 10% of total state income tax revenues through LGDF. Following a temporary increase in state income tax rates in 2011, the percentage of tax revenue allocated to LGDF for distribution to local counties and municipalities declined to 6%.

In January 2015, the local share of the state income tax increased to 8% when the higher income tax rates declined according to a predetermined schedule established by law.

The state income tax was permanently increased in 2017 and the local government share was reduced to 5.45% for individual income tax collections and 6.16% for corporate income tax collections for State Fiscal Year (SFY) 2018.

The LGDF share was slightly increased within the SFY 2021 state budget and is presently 6.06% for individual income tax collections and 6.845% for corporate income tax collections. This is significantly below the 10% share received by counties and municipalities prior to January 2011.

Local governments have been shorted billions of dollars over the last decade as a result of the LGDF percentage being reduced. These revenues instead went towards the State's budget deficit.

TAKE ACTION NOW!

During the first week of March 2021, ISACo Executive Director Joe McCoy sent letters to Governor Pritzker and the four Legislative Leaders expressing ISACo's opposition to the proposed cut and urging a full restoration of LGDF distributions to pre-2011 levels.

The letter to the Governor is available here and the letters to the four Legislative Leaders can be viewed here.

It is imperative that you let Governor Pritzker and your State legislators know that LGDF revenue belongs to counties and municipalities and that the State budget must not be balanced on the backs of local governments. ISACo has developed a model letter that can be modified and sent to the Governor and your county’s state legislators. We have also prepared a resolution that can be discussed and adopted during your county board meeting and then forwarded to the Governor and your state legislators.

Model Letter Opposing LGDF Reduction

Model Resolution Opposing LGDF Reduction

TELL YOUR LOCAL STORY

ISACo wants to learn how LGDF revenue benefits your county. What personnel and programs does it help fund? What can your county afford to purchase based upon the revenue received? How does the revenue contribute to reducing the need for local tax increases? Please submit your county's story here.